Reducing Balance Method Formula

To do this we can use the reducing balance depreciation rate formula. The calculator uses the future value of a lump sum.

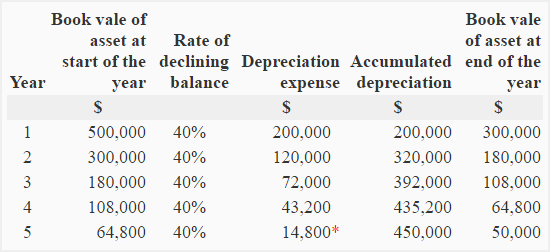

Declining Balance Method Of Depreciation Accounting For Management

This will end up calculating your remaining book value.

. Depreciation rate per cent is calculated on cost of assets each year. This method ignores residual value since the NBV under this method will never reach zero. Under the Declining Balance Method Formula the depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

Declining Balance Depreciation C B V D R where. This reducing balance depreciation calculator works out the accumulated depreciation of an asset using the reducing balance method. That percentage will be multiplied by the net book value of the asset to determine the depreciation amount for the year.

The 200 reducing balance method divides 200 percent by the service life years. Subtract the depreciation charge from the. Under this method the depreciation charge will be higher in the earlier years and reduce over time.

It can be zero. The 150 reducing balance method divides 150 percent by the service life years. Declining Balance Method Formula.

Example of EMI Calculation using Reducing Balance Formula. Use the following balance formula to calculate the depreciation. You want to use the 200 reducing-balance formula and to depreciate this system over five years.

You then take the depreciation charge and subtract it from your current book value. Formula Depreciation rate Net Book Value NBV Net book value NBV Carrying value cost accumulated depreciation to date. The rate remains the same but the amount of depreciation diminishes gradually.

Depreciation charge per year net book value. Using the Reducing balance method 30 percent of the depreciation base net book value minus scrap value is calculated at the end of the previous depreciation period. That percentage will be multiplied by the net book value of the asset to determine the depreciation amount for the year.

The first step is converting the annual interest to a monthly interest by dividing it by 12. Lets say you buy a computer server for your business for 25000. Number of repayments 3 months.

Try and repeat these steps throughout the assets life. Depreciation Expenses Net Books Residual Value Depreciation Rate. 5000 x 200 10000.

For your first year. You assume that theres no salvage value. Calculate the depreciation charge using the following formula.

25000 5 years 5000. Example of reducing balance depreciation Suppose that the fixed asset acquisition price is 11000 the scrap value is 1000 and the depreciation percentage factor is 30. Using this information the reducing balance method calculates depreciation in two steps.

Both loans are versions of the reducing balance method Another kind of loan more common in microfinance than in domestic consumer loans is the flat rate loan in which loan interest payments remain constant over the course of the loan. PV 100000 n 8 years i -25 rate is negative as the asset value is declining FV Net book value PV x 1 i n FV Net book value 100000 x 1 - 25 8 FV 1001129. Carrying Value of Assets is equal to the book value of assets less accumulated depreciation.

Using the formula above calculate the EMI of a loan using the information below. Net book value - residual value x depreciation factor the depreciation charge per year. Depreciation expenses are the expenses that charged to assets for a specific period or based on specific systematic ways.

The reducing balance method is often referred to as the declining balance method which is more fully discussed in our declining balance depreciation tutorial. How to calculate DEPRECIATION using the Reducing Balance Method Diminishing Balance MethodTutorial on how to calculate depreciation using the Straight line. The rate and amount of depreciation remain the same each year.

Cost required argument This is the initial cost of the asset. C B V current book value D R depreciation rate beginaligned textDeclining Balance Depreciation. Its value indicates how much of an assets worth has been utilized.

VDB cost salvage life start_period end_period factor no_switch The VDB function uses the following arguments. Salvage required argument This is the value of an asset at the end of the depreciation. Principal 100 000 Interest rate 18 per annum.

We can write this formula in excel by taking 1 minus the salvage value which is also known as the residual value divided by the original cost of the asset to the power of the inverse of the useful life. The reducing balance depreciation for period 8 is then 1334839 1001129 333710.

Depreciation Formula Examples With Excel Template

Reducing Balance Depreciation What Is Reducing Balance Depreciation

Reducing Balance Method For Calculating Depreciation Qs Study

No comments for "Reducing Balance Method Formula"

Post a Comment